So-called ‘free credit’ offers come with costly catches

Buy Now Pay Later (BNPL) plans increasingly are being offered as a convenient credit alternative that enables purchases to be made in installments, typically four payments over six weeks. The so-called “fintech” (financial technology) companies offering these plans often advertise them as providing consumers interest-free payments with no impact to credit scores.

But consumer groups and economic justice organizations point out that these financial products that already affect 8.42 million consumers may be just another explosive form of predatory lending that exploits unsuspecting consumers through a lack of transparency that usually leads to confusion about the true terms and consequences that come with the product. Without effective regulation, millions of more consumers could be financially duped by BNPL.

Consumers can use BNPL offerings from firms such as Affirm, Klarna, PayPal Pay in 4, Sizzle and others at brick-and-mortar stores like Macy’s, Footlocker, Target, and Walmart, as well as online retailers like Amazon.

BNPL purchases require direct payment deductions from either credit or debit cards. Because each BNPL purchase comes with its own set of payment due dates-- unlike the fixed payment date for a credit card bill – these ongoing deductions can easily lead to consumers incurring additional bank fees assessed for insufficient funds and overdrafts. And many BNPL transactions do not automatically come with product return and/or fraud protections that credit cards offer. Instead, these credit terms are currently at the discretion of BNPL providers. As a result, consumers can end up with no merchandise, while their money still is being taken from debit or credit card accounts.

Complaints to the Consumer Financial Protection Bureau (CFPB) and Better Business Bureau have noted several consumer issues including lack of information about initiating disputes, delays in receiving refunds, and continued demand for repayment from BNPL lenders.

This past November, Marisabel Torres, the Center for Responsible Lending’s Director of California Policy testified to Congress that BNPL loans typically are designed to avoid coverage under the Truth in Lending Act (TILA).

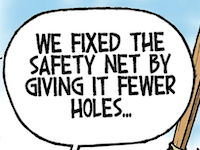

“That law excludes from the definition of “creditor” one who extends credit that doesn’t require a finance charge and is repayable in four or fewer installments… The fact that this appears to be a “free credit” product raises the question: What’s the catch?”

“It turns out there are a number of catches – some demonstrable, some potential – which require regulatory attention and response,” added Torres.

Advocates say many adverse effects could be avoided if BNPL lenders were required to verify a consumer’s ability to repay before the first loan was made. Instead, like payday loans, each billing cycle tends to worsen, rather than improve, the borrower’s financial position, dragging them deeper into the debt trap.

Just a month later, in December 2021, consumer and economic justice advocates applauded the CFPB when it announced that it would open an inquiry into large BNPL lenders.

“In opening this inquiry, the Consumer Bureau is taking a great first step in learning about this industry and toward preventing harm to consumers,” said CRL’s Torres.

Without vigilant monitoring and appropriate regulation, Torres and other advocates warn that products promising to promote financial inclusion may instead exacerbate financial exclusion.

This March, a coalition of 77 organizations representing national consumer organizations and advocates in 16 states and the District of Columbia, sent a letter urging CFPB to treat BNPL as a form of credit, and to subject lenders offering the products to regulation under appropriate consumer financial protection laws such as TILA , This law requires responsible underwriting, fee disclosures, and the ability to dispute charged items.

Without regulation, the rising use of BNPL could bring new financial harms to consumers, especially those with the fewest financial resources.

• • •• • •

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it..