Huge health care companies still seeking to keep much of it secret

A pharmacy manager retrieves a a medication. Credit: Joe Raedle/Getty Images.

It seems to be an object lesson in the importance of government transparency.

Revelations that quite possibly led to a lawsuit and a billion-dollar settlement by the nation’s largest Medicaid managed-care provider almost never came to light, according to court documents filed last month.

Meanwhile, huge drug middlemen are fighting to keep sealed damning information that’s already been reported in the press.

After languishing for more than three years, a lawsuit filed by the fourth- and fifth-largest corporations in the country against the Ohio Department of Medicaid is scheduled to finally go to trial in the Franklin County Court of Common Pleas on Sept. 9.

It pits pharmacy benefit managers owned by CVS Health and United Health Group against the state as they fight to protect what they regard as trade secrets and what the state’s lawyers say is public information regarding huge sums of taxpayer dollars.

Whichever side prevails, some of that information is undeniably embarrassing to some of the corporations under contract to administer the health program that serves the poorest 25% of Ohioans.

Paying and getting paid

Ohio contracts with five Medicaid managed-care plans to administer benefits for the great majority of the state’s Medicaid clients. In 2018, four of them contracted with CVS’s pharmacy benefit manager, CVS Caremark, to handle prescription drug benefits. The fifth, United, contracted with its own PBM, OptumRx, for the service.

Among their functions, pharmacy benefit managers decide how much to reimburse pharmacies for drugs they buy and dispense.

That’s potentially a conflict for CVS, given that it owns not only the nation’s largest PBM, but also the largest pharmacy retailer. So on behalf of roughly 80% of Ohio Medicaid clients in 2017, CVS was deciding how much to pay its own pharmacies and those of its competitors.

By 2018, community pharmacists around Ohio had long been complaining that — especially in the Medicaid program — the PBMs’ reimbursements for their drugs were so low they were being driven out of business. And many suspected that CVS was doing so to help its own retail stores.

while CVS billed one managed-care organization, Buckeye Health Plan, $33 million for prescription drugs, a second PBM, Envolve Pharmacy Solutions, billed Buckeye $20 million more. Buckeye and Envolve are owned by the same corporation, Centene… The resulting rate of markups was almost twice as high

CVS denied that its business units worked together in such a fashion, but possible proof of the pharmacists’ suspicions emerged in the fall of 2017. They noticed that reimbursements from CVS Caremark took a particularly steep plunge and then they got a letter from CVS Pharmacy.

“I’m a pharmacist myself,” said the one-page letter from Shane Stockton, regional director of acquisitions. “I know what independents are experiencing right now: declining reimbursements, increasing costs, a more complex regulatory environment. Mounting challenges like these make selling your store to CVS Pharmacy an attractive and practical option.”

Penetrating the back box

As news coverage of that and other issues intensified, the administration of then-Gov. John Kasich demanded that CVS Caremark and OptumRx hand over their secret reimbursement info so the Medicaid department could see for itself what was going on. In April of 2018, the PBMs agreed.

The information was gathered and an outside firm, Healthplan Data Solutions, analyzed it. By June 15, 2018, a report and an executive summary were completed.

Some of the information in the summary was bad enough for the PBMs.

It said that in 2017 CVS Caremark and OptumRX charged the state $224 million more for drugs than they paid pharmacies. The state’s analyst said that was at least three times the going rate.

But on the other side of the coin, the summary also highlighted information that seemed to rebut a key charge community pharmacists were making: that CVS was giving unfair advantage to its own pharmacies. The summary said CVS was actually paying independent pharmacies over 3% more than it was paying its own.

According to documents made public last month, the matter could well have rested there.

It’s a case in which CVS and Optum are fighting to keep an unredacted version of the Healthplan Data Solutions report from being released, so many of the depositions and other documents have been filed under seal. But on July 1, an unsealed portion of a 2020 deposition of Healthplan founder Gary Rutherford was posted as part of the case file.

Referring to his firm’s analysis of reimbursement data, Optum attorney Katheryn M. Lloyd asked Rutherford whether it had “been your understanding that only the executive summary was intended for public consumption, whereas the additional remaining detail was only meant for (the Medicaid department) itself, and not the larger audience?”

Rutherford replied, “That would be true.”

Bigger revelations

If that stayed the case, some crucial information would have remained hidden.

Amid media clamor for more details, the Medicaid department on July 13, 2018, said it intended to release the full report — without redactions. Three days later, Optum and CVS filed the suit that is slated for trial next week.

As the PBMs and the Medicaid department haggled in court about what portions of the report constituted trade secrets, they agreed to a heavily redacted version that was released on Sept. 18, 2018.

Despite all the black marks, there was an important item that wasn’t redacted — and it wasn’t in the executive summary.

In addition to the $224 million in markups, there was another one worth $20 million.

A note accompanying the item said that while CVS billed one managed-care organization, Buckeye Health Plan, $33 million for prescription drugs, a second PBM, Envolve Pharmacy Solutions, billed Buckeye $20 million more.

Interestingly, Buckeye and Envolve are owned by the same corporation, Centene, and the resulting rate of markups was almost twice as high as those of the other managed care organizations, the report showed. This despite the fact that Rutherford had concluded that all were over-billing taxpayers by a lot.

Centene and CVS had a hard time explaining what the taxpayers got for their $20 million.

Asked what Envolve did for all that money, the Medicaid department said “utilization management, specialty management, data analytics, drug utilization review and formulary management.”

When a CVS spokesman was asked whether his company provided those services to Buckeye, he replied, “We provide all of the services you listed to our Medicaid (managed-care organization) clients in Ohio.”

So what did Centene’s PBM do? CVS and Centene denied that there was any double-dipping at taxpayer expense; the two PBMs instead had merely provided different services within those categories.

Further investigation

Dave Yost apparently didn’t buy it.

As state auditor in August 2018, he released his own report on the PBM’s business with Ohio Medicaid. It pointed out several potential problems, but without access to the kinds of confidential information used in the Medicaid department’s analysis, it couldn’t make definite conclusions.

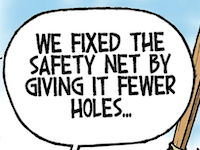

So if only the executive summary of that analysis had been made public, it seems likely that he wouldn’t have learned of the $20 million discrepancy.

In any case, Yost opened another investigation after he became attorney general at the start of 2019. In a lawsuit filed in March, Yost said that Buckeye had stacked yet another Centene-owned PBM into its drug transactions and had over-billed Ohioans in several years, not just 2017.

In June, Centene settled the case for $88.3 million — and it announced that it was setting aside more than $1 billion to settle similar claims in 21 other states. Ohio’s was the first — and only — lawsuit to be filed.

All, apparently, the product of an act of transparency back in 2018. Asked what motivated the Medicaid department to reverse itself and press for the release of the Healthplan Data Solutions report, a spokeswoman last week said she couldn’t comment because of the lawsuit that’s coming to trial.

Other inconvenient facts

In the litigation, CVS is trying to keep covered up in the public report some embarrassing facts that have already been exposed.

The executive summary that everybody agreed to release made much of the fact that in 2017 CVS reimbursed independent pharmacies somewhat better than its own. But an unredacted copy of the full report obtained by The Columbus Dispatch showed that CVS had reimbursed some of its largest competitors much, much worse.

Companies such as Walmart and Kroger have been notably reticent about commenting on reimbursements, but industry insiders say the companies have long been complaining about vanishing pharmacy profits.

The data from 2017 might show why: The report said that CVS would have to pay Walmart pharmacies 46% more to bring the retail giant up to par with CVS pharmacies. Kroger would have to be paid 25% more to be on an equal footing, it added.

The data also might hint at why Target in 2015 sold its pharmacies to CVS.

As with Centene’s discrepancies, none of this might not have been known if Ohio Medicaid stuck with its original plan and only released a summary of what the country’s two biggest healthcare corporations were doing with taxpayer money.

• • •• • •

This story is provided by Ohio Capital Journal, a part of States Newsroom, a national 501 (c)(3) nonprofit. See the original story here.