Probably the most important message entrepreneurs are getting from experts right now is this: Be careful!

More than ever — now is the time for business owners to pay close attention to macroeconomic trends.

Following several months of three-quarter percent interest rate hikes by the Federal Reserve Bank — which were raised to counter aggressively sharp increases in consumer prices — many small businesses are closely watching their bottom lines to decide their next moves.

Due to the Fed’s recent moves, the Fed Funds Rate — which is the base rate that banks lend to each other — has nearly tripled so far this year, from less than one percent to between 3.0% and 3.5% currently.

Black unemployment in the U.S. was officially tracked last month at 5.8%, not far from the lowest level ever recorded by the Bureau of Labor Statistics, which was 5.4% in August 2019.

The current economic climate is definitely blowing strong cross-currents.

The economic indicators have been difficult for business owners, bankers, analysts, and consumers to figure out. Inflation has been raging at an annual rate of well over 8%, while interest rates have nearly tripled in recent months.

All of this is happening even while the U.S. Department of Commerce’s Bureau of Labor Statistics (BLS) reported the nation’s unemployment rate in September averaged 3.5% — and has remained close to its lowest levels in about 50 years.

The reasonably positive low jobless indicators — at least on paper — also translated to African Americans. Black unemployment in the U.S. was officially tracked at 5.8%, which is not far from the lowest level ever recorded by the Bureau, which was 5.4% in August 2019.

U.S worker salaries are expected to rise by 3.9% for 2022 — the fastest level since 2008.

The low unemployment levels underscore numerous anecdotal and media reports of labor shortages in certain industries — specifically in hospitality, education, medical, manufacturing, and transportation sectors. This includes a strong need for everything from teachers, school aides, hospital personnel, warehouse workers, medical technicians, and truck drivers.

Throughout the second half of 2021 to the summer of 2022, most of the news focus was on the “Great Resignation” — the ability of workers to fairly easily find employment and demand higher wages — following the economic and societal lockdown of the COVID-19 Pandemic of 2020.

The recently strong job data means that U.S worker salaries are expected to rise by 3.9% for 2022 — the fastest level since 2008, just before the sharp recession that began that year.

But as is normally the case in economics or business, there are crosswinds to consider.

Recent trends in inflation, which is loosely defined as the rate by which prices for goods and services have and are expected to increase, are now at their highest levels since the early 1990s. The BLS estimated the inflation rate of 8.2% in September 2022, down somewhat down from the 9.1% estimated in August, but still much higher than the 5.4% rise recorded for the same month in 2021.

Most experts have attributed the sharp rise in the price of most consumer items to a combination of global factors:

- Global supply bottlenecks originally caused by the COVID pandemic

- Explosion of pent-up consumer demand for goods and services after the COVID Pandemic;

- Higher consumer demand from higher wages;

- Supply disruptions and shortages resulting from Russia’s invasion of Ukraine;

The rub from all of this is that general pay increases that most workers received have been nearly completely eroded by the sharp rise in consumer prices for food, gasoline, medicine, clothing, rent, and entertainment.

The combination of all of these economic forces — higher interest rates, higher wages for workers, and higher prices for supplies — ultimately means higher costs for small businesses.

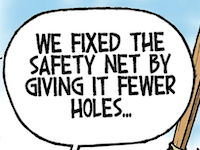

Higher prices and higher interest rates also mean consumers have less money to buy the goods and services that small businesses offer. The recent rise in interest rates — which results from the Federal Reserve’s efforts to lower demand and prices — could trigger a recession, as companies begin to trim workforces to accommodate lower consumer demand.

Businesses will have to take special measures to protect themselves against the potential storm of a possible recession touched off by a sharp rise in interest rates. I will highlight potential measures that entrepreneurs need to take in my next column.

• • •• • •