WASHINGTON — As the Biden administration prepares to defend its student debt cancellation program before the U.S. Supreme Court on Feb. 28, data shows that black borrowers have the most to lose should a majority conservative court strike down the policy.

Black borrowers hold a disproportionate share of student loan debt, and many likely were recipients of Pell Grants, federal aid to help low-income students pay for higher education. Those federal student loan borrowers who received Pell Grants could qualify for up to $20,000 in debt forgiveness under the administration plan.

Fenaba Addo, an associate professor of public policy in the Department of Public Policy at the University of North Carolina at Chapel Hill, with her colleagues has studied the rise in student debt. They have looked at which borrowers have disproportionately accumulated the most debt and are struggling the most with repayments, as well as which borrowers are overly concentrated in the pools of defaulters.

“Time and time again, we see black borrowers over-represented in both of those groups and really struggling with the current policies and programs in place that reportedly were supposed to be assisting and helping borrowers pay down their debts,” she said.

On average, black college graduates at the time they leave school owe $7,400 more than their white peers, or $23,400 versus $16,000. But within four years after graduation, due to differences in interest accrual and graduate school borrowing, black borrowers hold about $53,000 in student loan debt, or nearly twice as much as their white peers. — Brookings Institution study

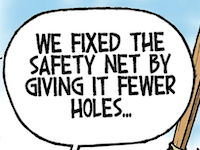

Addo pointed out some policies in place that were targeted to help low-income students, such as Pell Grants, “but that didn’t keep up with inflation over time.”

“The solution has been a debt solution,” she said. “It hasn’t been, let’s figure out how to increase resources, economic resources of households, or how to get people more income. It’s been let’s figure out a way to saddle them with debt.”

On average, black college graduates at the time they leave school owe $7,400 more than their white peers, or $23,400 versus $16,000, according to a study by the Brookings Institution. But within four years after graduation, due to differences in interest accrual and graduate school borrowing, black borrowers hold about $53,000 in student loan debt, or nearly twice as much as their white peers, the study found.

Lawsuits challenge White House reasoning

In its initial explanation of its student loan forgiveness program when it was announced in August, the White House acknowledged that the policy would help “advance racial equity.”

The statement said: “Black students are more likely to have to borrow for school and more likely to take out larger loans. Black borrowers are twice as likely to have received Pell Grants compared to their white peers. Other borrowers of color are also more likely than their peers to receive Pell Grants. That is why an Urban Institute study found that debt forgiveness programs targeting those who received Pell Grants while in college will advance racial equity.”

That reasoning was the basis of one of two lawsuits that is before the Supreme Court and seeking to overturn the Biden administration’s debt relief policy. Lower courts have put the program on hold, preventing the administration from issuing debt relief to 16 million borrowers who have already been approved for forgiveness by the U.S. Department of Education.

The policy would cancel up to $10,000 in federal student debt for borrowers earning up to $125,000 annually, or up to $250,000 for married couples, with the boost to $20,000 in forgiveness for Pell Grant recipients. The program only applies to current borrowers, not future ones, and income levels for the 2020 and 2021 tax years would be considered. Those who have private student loans are not eligible.

So far, the Department of Education has collected more than 24 million applications for the relief program.

The first lawsuit, from a conservative advocacy group out of Wisconsin, charges that the White House’s debt relief plan violates federal law because it seeks to help black borrowers and help narrow the racial wealth gap.

White households hold 86.8% of overall wealth, though they account for only 68.1% of the households in the Survey of Consumer Finances. By comparison, black and Hispanic households hold only 2.9% and 2.8% of wealth, respectively, while accounting for 15.6% and 10.9% of the U.S. population, “reflecting the fact that wealth is disproportionately skewed towards white households,” according to the Federal Reserve.

Over the past two decades, black students and people aged 50 and older have become the fastest growing category of student loan borrowers, according to the most recent Federal Reserve data.

Data from the Federal Reserve also found that black and Hispanic borrowers are “more likely than white borrowers to be behind on their loan repayment and are also less likely to have repaid their loans.”

The U.S. Department of Education does not regularly track borrowers by race, but noted that black graduates were more likely to take on student debt. A study by the NAACP found that “across all racial groups, black borrowers hold the most student loan debt.”

A report by the Roosevelt Institute, a liberal think tank, found that broad-based federal student debt cancellation would most benefit black and brown borrowers, and would also be an effective tool to grow the black middle-class.

The other suit, from Republican attorneys general of Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina, argues that the Biden administration overstepped its reach and that the plan threatens the revenue of those states’ businesses that profit from federal student loans.

A federal judge in Missouri originally rejected the six-state lawsuit, ruling that those states lacked legal standing to pursue a case on the grounds that they will be harmed in the future.

The appeals court later found that Missouri had shown likely injury, because a major loan servicer — Missouri Higher Education Loan Authority, known as MOHELA — that is based in the state would lose revenue because of the debt relief program.

HEROES Act

The White House has stood by its policy, arguing that the 2003 HEROES Act allows the administration to enact its debt relief program. That law gives the secretary of education the authority to respond to a “national emergency” and “waive or modify any statutory or regulatory provision” so that student loan borrowers are not “placed in a worse position financially” due to a national emergency.

The main author of the HEROES Act, George Miller, a former Democratic congressman from California who served as chair of the House Education and the Workforce Committee, wrote in a recent opinion piece in The Washington Post that there was no doubt that the coronavirus pandemic constituted a national emergency. He noted that former President Donald Trump declared COVID-19 a national emergency and that President Joe Biden has extended that twice.

The Trump administration issued a pause on federal student loan repayments because of the pandemic, and the Biden administration has extended the pause several times.

“The Biden student debt relief plan achieves our goal of ensuring that student-aid recipients are not put in a worse position by a national emergency,” Miller wrote. “(E)ducation officials determined that the debt-relief plan was necessary to ensure that borrowers would not default on their loans when pandemic-related payment pauses — in place since March 2020 — expired at the end of 2022.”

The Congressional Budget Office has estimated that the program would cost up to $400 billion over 30 years. More than 43 million Americans have student loan debt, and the Federal Reserve estimates that the total U.S. student loan debt is more than $1.76 trillion.

Rally outside the court

Regardless of the court outcome, the pandemic-era pause on federal student loan repayments will lift on June 30, and those borrowers will be required to begin repayments either after the Supreme Court’s decision or 60 days after the June deadline.

On the day of the oral arguments on Feb. 28, more than 20 advocacy groups and several congressional Democrats are planning to rally outside the Supreme Court. Some of those groups include the NAACP, the Student Borrower Protection Center, American Federation of Teachers and New Georgia Project.

“Student debt cancellation is one of the defining issues of my generation,” Maggie Bell, the lead organizer for New Georgia Project’s C.L.E.A.R. campaign, said in a statement.

“I speak to black and brown student borrowers across Georgia every day: the burden of their debt is heavy. Many of us fear we may never be able to own a home, raise a family, or retire without our student debt being cancelled. What about our reality is the ‘American Dream?’”

The campaign stands for Cancel Loans for Education and Reparations, and specifically organizes Georgia borrowers around full student loan debt cancellation.

Democratic lawmakers expected to join advocates include U.S. Senate Majority Leader Chuck Schumer of New York; Sens. Bob Menendez of New Jersey and Elizabeth Warren of Massachusetts; and Reps. Ayanna Pressley of Massachusetts, Ilhan Omar of Minnesota, Maxwell Frost of Florida and Pramila Jayapal of Washington state.

Warren and Schumer have called for the Biden administration to cancel as much as $50,000 in federal student loans, arguing that the president has the executive authority to do so.

• • •• • •

This story is provided by Ohio Capital Journal, a part of States Newsroom, a national 501 (c)(3) nonprofit. See the original story here.