COMMENTARY

Sooner or later, bad ideas arrive on our doorsteps. In recent years we have had new policies and proposals such as guns in bars and gun sanctuaries—something not permitted in some lawless places in the 19th century old west. Now it’s vouchers and tuition tax credits. Five organizations, led by the Montgomery County Dialogue on Race, sent the following statement to the Montgomery County Board of Supervisors.

[We] are alarmed to learn that the Montgomery County Virginia Board of Supervisors is considering including the use of public funding to support vouchers or tax credits to private schools in their legislative priorities. We oppose this move, as we are committed to issues of equity and justice in our community, including any matters that negatively affect our local schools and students. Unfortunately, using public funds in this manner is not in line with providing equity for all public-school students.

There are many problems with vouchers and tax credits. While parents should have the right to choose where they send their children, scarce public funds should not be used to support the choice of private schools because—among other issues—these schools often do not abide by all Federal, State, and local civil rights laws.

In the late 1950s and early 1960s, seven states across the South enacted voucher and tuition tax credit plans to subsidize white families fleeing the integration of public schools.

For example, private schools can deny admission of some students based on their race, sexual orientation, or religious beliefs. However, students in public educational institutions are protected under federal programs such as Title VI and Title IX. Also, students with disabilities who require more expensive support services could be denied admission to these private schools.

It may be helpful for us to remember that a shameful part of Virginia’s recent history involves the use of vouchers and tuition credits. In the late 1950s and early 1960s, seven states across the South, including Virginia, enacted voucher and tuition tax credit plans to subsidize white families fleeing the integration of public schools. The result was devastating consequences for African American students.

Another reason we oppose this voucher and tax credit proposal is because private schools do not have the same level of accountability and transparency as public schools. Private schools are not required to report how they spend funds. Tax dollars need to be accounted for.

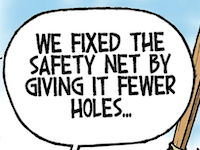

Our local public school system needs additional resources and funding to improve the educational needs of all our children. However, reducing public funding by providing vouchers and tax credits to private schools may lead to many inequities in the educational system, an unacceptable result.

Independent evaluations of voucher programs in Ohio and elsewhere show that students who used vouchers to attend private schools actually lose ground to their public-school peers.

In summary, we should not provide state funds to schools that are not held to the same standards as public schools and do not provide transparency regarding the curricular content or students’ achievement levels. We ask that the Montgomery County Board of Supervisors remove the legislative priority concerning school vouchers and tax credits. The citizens of Montgomery County deserve better than this.

RELATED:

And importantly, voucher programs do not work. Independent evaluations of voucher programs in Ohio, Louisiana, Indiana, and the District of Columbia show that students who used vouchers to attend private schools actually lose ground to their public-school peers.

• • •• • •