Environmentalists mount legal challenge; others critical of minimal taxes on extraction

Energy companies, lawmakers, and environmental groups are again arguing over the companies’ ability to drill for oil and gas in Ohio state parks.

And as they battle over the firms’ ability to drill for profits on taxpayer-owned land intended for recreation and conservation, it raises another question that isn’t exactly new: Are the companies paying their fair share in taxes?

State law already allowed energy producers to drill on state parklands. But during last year’s lame-duck session of the legislature, without hearings the Ohio Senate amended an agricultural bill focused on poultry to add a provision that would require state officials to grant drilling leases so long as the applicants met certain requirements.

The Ohio Environmental Network and other groups have sued, claiming the law, signed by Gov. Mike DeWine, violates a constitutional requirement that bills address a single subject. That might be a winnable argument, given that it both sets the “number of poultry chicks that may be sold in lots” and makes it easier to drill for oil and gas in state parks.

But a Franklin County judge last week denied a request to temporarily block the law, saying that the environmental groups failed to show imminent harm, the Cleveland Plain Dealer reported. The groups, however, fear that state agencies might be forced to sign leases before a newly formed Oil and Gas Management Commission is up and running later this year and they plan to pursue the case, the paper reported.

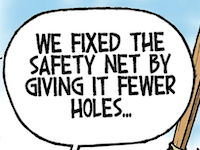

As lawmakers grant energy producers greater freedom to exploit Ohio’s taxpayer-owned lands, there have been long-standing complaints that the companies don’t do right by those same taxpayers. Critics say that Ohio’s “severance” taxes — what energy companies pay to extract oil and gas — are among the lowest of any state.

– United States Geological Survey

“Ohio’s severance taxes are pitiful, and they have meant a severe missed opportunity for Appalachia and for Ohio as a whole,” Guillermo Bervejillo, state policy fellow at Policy Matters Ohio, said in an email Tuesday. “Ohio drilling operators pay a dime per barrel of crude oil and half a nickel per thousand cubic feet of natural gas. This is one of the lowest severance taxes in the country and it means that years of gas and oil production have enriched corporations and drillers but not the communities that host them nor the state that supports them.”

It’s difficult to compare how much various states tax oil and gas production because many different methods are used. Some states’ taxes are based on the volume of minerals pumped out of the ground, some are based on the value, some are based on both — and a few are based on neither.

A 2016 analysis by economists Daniel Raimi and Richard Newell looked at severance taxes by the 16 largest oil-and-gas producing states and attempted to make an apples-to-apples comparison. It looked at state and local government revenue as a share of the value of oil-and-gas produced in the state.

The study found by that measure, Ohio’s severance taxes were by far the lowest of the 16 states — less than half those in the next-lowest, Arkansas. They were less than a 30th of the highest, Alaska.

The latter might be a special case, because nearly 40% of state and local revenue there came from severance taxes. But the median states — Utah and Texas — were taxing oil and gas production at seven to eight times the rate Ohio was, according to the study.

However, the data the economists used were from 2013 and some things have changed since.

“In 2009 (the Ohio Oil and Gas Association) worked with Republicans and Democrats on Senate Bill 165, which essentially doubled the severance tax in Ohio with the goal of fully funding the state’s oil and gas regulatory programs,” Ohio Oil and Gas Association spokesman Mike Chadsey said in an email. “There is ongoing competition among states for drilling capital among producers. Ohio’s severance tax works as designed — to keep Ohio competitive with other producing states, funding a robust regulatory program recognized as one of the nation’s best, and funding one of the few state-sponsored orphan well plugging programs.”

However, some policymakers apparently didn’t agree that the increase was adequate.

In 2015, former Republican Gov. John Kasich proposed to increase Ohio oil and gas taxes to 6.5%, in part to pay for a proposal to slash state income taxes. The proposal didn’t make it through the legislature.

If it had been enacted, the increase could have produced significant revenue. A 2021 analysis by Policy Matters found that if severance taxes on oil and gas had been raised to 5% in 2016, it would have raised an additional $1.24 billion in revenue over the next five years.

Instead, the state has little to show for the billions worth of natural gas extracted from Belmont, Carroll, Guernsey, Harrison, Jefferson, Monroe, and Noble counties, Bervejillo said. He cited an Ohio River Valley Institute report finding that between 2008 and 2019, those counties “had a net job loss of 8%, growth in personal incomes lagged state and national averages, and the local population decreased by over 5%,” Bervejillo said.

Even so, Chadsey of the oil and gas association said that Ohioans benefit under the current system of energy production — including from state parklands.

“The responsible development of Ohio’s natural resources beneath public lands will benefit Ohioans in the place where they need it most: the pocketbook,” he said. “Ohioans will continue to enjoy all the recreation and benefits that public spaces provide.”

RELATED: Don’t frack our state parks to fund tax cuts for the rich

• • •• • •

This story is provided by Ohio Capital Journal, a part of States Newsroom, a national 501 (c)(3) nonprofit. See the original story here.