A consumer watchdog last week asked state regulators to revisit their decision to allow two Ohio utility companies to pass onto customers their losses on two coal-fired power plants they partially own.

The Ohio Consumers Counsel (OCC), which represents residential ratepayers in utility issues, asked the Public Utilities Commission of Ohio (PUCO) to revisit its subsidy approvals granted to American Electric Power (AEP) and Duke Energy in 2018.

The approvals allowed the companies to pass on to customers losses incurred by the utilities’ equity and power-sharing agreements associated with the Clifty Creek coal plant in Madison, Indiana and the Kyger Creek plant in Cheshire, Ohio.

The plants are operated by the Ohio Valley Electric Corp. (OVEC), whose ownership is split between several Ohio utility companiesincluding AEP, Duke Energy, Dayton Power and Light (now known as AES Ohio), and others.

PUCO in 2018 began approving the subsidy requests from AEP, Duke and AES. Those subsidies were eventually codified, elongated by several years, and expanded via House Bill 6 in 2019. Ratepayers statewide now pay a maximum $1.50 per month — $1,500 per month for industrial ratepayers — in a fee called a “Legacy Generation Rider.”

When the subsidies expire in 2030, they will be worth an estimated $700 million to the plants’ owners.

HB 6 is now at the center of a public corruption prosecution. The U.S. Department of Justice accused former House Speaker Larry Householder, R-Glenford, and four allies of secretly accepting nearly $61 million from FirstEnergy Corp. and using it to enrich themselves and engineer passage of the legislation. It also gutted Ohio’s clean energy laws and bailed out nuclear plants formerly owned by a FirstEnergy subsidiary.

Householder pleaded not guilty and awaits trial. Two alleged coconspirators pleaded guilty. Householder has been expelled from the House; the nuclear bailout and another key provision of HB 6 favorable to FirstEnergy has been repealed; and pending legislation could revoke the Ohio Valley Electric Corp. bailouts outright.

However, the charges to ratepayers continue.

“This case is about consumers, and the two old coal plants would probably have closed long ago if shareholders had to pay for the plants’ losses,” OCC lawyers wrote.

“The utilities can keep running the plants because the PUCO requires consumers to subsidize them.”

If the motion were granted, the burden of proof would be on AEP and Duke Energy to demonstrate their OVEC losses, which ratepayers are on the hook for, were prudently incurred and with customers’ best interests in mind.

OCC attorneys cited PUCO-ordered audits of the plants conducted by London Economics International, which found the “OVEC plants cost customers more than the cost of energy and capacity” than could be bought on wholesale markets. The OCC argued that were it not for a bailout funded by “captive” consumers, a prudent operator would close the plants.

AEP and Duke are the two of the three largest shareholders of OVEC. Coal fired power plants are major emitters of carbon into the atmosphere, which contributes to climate change. A 2009 study by the Institute of Southern Studies, using U.S. Environmental Protection Agency data, ranked Kyger Creek as the 29th worst polluting coal plant in America in terms of coal combustion waste.

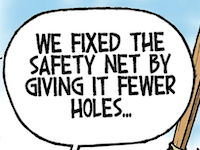

PUCO allowed the utilities that own OVEC to pass “riders,” or charges on top of regular electric bills, onto their customers to cover the OVEC losses. The utilities argued the riders would act as a “hedge” for consumers — a credit for consumers in good times in energy markets and a charge in the bad times. PUCO sided with the utilities.

However, as the utility companies themselves admitted at a legislative hearing last month, the riders have never worked as a credit for consumers.

In 2020, Ohio ratepayers spent $114 million subsidizing the coal plants, according to a PUCO spokesman. An audit conducted by the Ohio Manufacturers Association, which opposed HB 6 and joined the OCC on its recent filing, estimated the bailouts to be worth $700 million by the time they terminate in 2030.

An AEP spokeswoman said the company, which announced last month it received a subpoena from the U.S. Securities and Exchange Commission in connection with the HB 6 scandal, plans to oppose the OCC’s motion.

AEP is by far the largest shareholder in OVEC with about a 43% stake. A political nonprofit it exclusively bankrolled contributed $700,000 over three years to Generation Now — an account that federal prosecutors claim Householder controlled and secretly used to accept FirstEnergy’s funding.

A Duke spokesman said in an email the company is still evaluating the filing.

“Regardless, the annual audits for our Rider PSR are already subject to due process, including a hearing as ordered by the PUCO,” he said.

AES (formerly Dayton Power and Light) also received PUCO approval to subsidize its OVEC losses. The OCC has asked PUCO to revisit this subsidy as well, which the company opposed. The commission has not yet ruled on the matter.

The OCC’s effort is unlikely to quash the OVEC subsidies outright, given they’re codified in law, according to Neil Waggoner, a campaign representative with the Sierra Club, an environmental interest organization.

However, effectively demonstrating the imprudence of the losses incurred via utilities’ ownership of the OVEC plants could limit some of the charges passed on to consumers.

“It helps to kind of set the groundwork for stopping the bailouts down the road,” Waggoner said.

• • •• • •

This story is provided by Ohio Capital Journal, a part of States Newsroom, a national 501 (c)(3) nonprofit. See the original story here.