Prescription drugs sit on a pharmacist’s counter. Photo by John Moore/Getty Images.

In theory, the point of managed care is to save money by negotiating with providers for lower prices. So it would seem that the biggest managed-care providers would use their clout to negotiate the lowest prices from doctors and hospitals and for medicine.

But for at least one drug, the largest Medicare managed-care companies are forcing most of their patients to buy the most expensive version, according to an analysis that was published last week. The reason might have to do with the fact that the large care companies aren’t just big insurers, they also profit by managing pharmacy benefits.

The report by 46brooklyn Research, used federal and other data from the third quarter of this year to analyze which versions of a particular drug were available to participants in Medicare Part D, the managed-care portion of the government health program for Americans over 65.

The analysis looked at versions of the multiple sclerosis (MS) drug dimethyl fumarate. Until late 2020, the one version available in the United States was called Tecfidera.

So-called “brand name” drugs typically have sole access to the marketplace until their patents expire. That allows drugmakers to charge high prices — more than an $8,000-a-month list price in the case of Tecfidera — in part to recoup research costs.

When the drug’s patent expired in late 2020, cheaper generic versions streamed into the marketplace, many with list prices of less than $900 a month and some costing as little as $40 a month when purchased at pharmacies operating completely outside the insurance system.

But even with much cheaper versions available, four of the seven largest Medicare Part D insurers forced their clients to buy the more-expensive brand-name drug, the 46brooklyn report said.

The seven largest — Anthem, Cigna, CVS, Centene, Humana, Kaiser and UnitedHealth — cover 85% of Part D patients. And under their plans, nearly 60% of MS patients had no choice but to buy brand-name, $8,000-a-month Tecfidera if they wanted their insurance to cover it, the analysis said.

The four insurers that only covered brand-name Tecfidera — Humana, CVS, Centene and Anthem — didn’t respond to questions for this story.

And even for the 40% of patients who were allowed to choose generics, almost all found them on the lowest tier of their plans’ formularies. That meant the MS patients often had to pay 25% of a wildly inflated price out of their own pockets if they wanted generic versions of the medicine, the report said.

Why would the plans do this?

A big reason might have to do with the Part D companies’ affiliations with pharmacy middlemen known as pharmacy benefit managers, or PBMs. The middlemen work on behalf of insurers to create networks of pharmacies whose reimbursements PBMs determine.

CVS, Cigna and UnitedHealth are each affiliated with one of the three largest PBMs in the United States and combined, they’re estimated to control well over 70% of the PBM market place. In addition, each of the other four large Part D plans has an affiliated PBM of its own, often contracting part of its business out to one of the big three, said Antonio Ciaccia, CEO of 46brooklyn and a former lobbyist for the Ohio Pharmacists Association.

Crucially, another function of PBMs is to negotiate rebates from manufacturers of brand-name drugs. The manufacturers offer the PBMs steep discounts in exchange for the PBMs giving their drugs favorable treatment on their formularies — lists of which drugs are covered and to what extent.

The large PBMs say that the rebates benefit their customers because they pass most of the discounts along. But the system is shrouded in secrecy and it’s often unclear what portion the huge companies keep for themselves.

It’s widely believed that drugmakers raise list prices to accommodate the ever-bigger rebates they grant to get favorable treatment by PBMs that represent so many millions of customers.

A paper by the University of Southern California’s Schaeffer Center for Health Policy and Economics concluded that every $1 in rebates drugmakers grant results in a $1.17 increase in list prices. If you’re covered, you don’t have to pay that price, but it affects how much you pay if you’re not insured, or once you’ve entered Medicare’s infamous “donut hole” — the point at which the recipient has to pay a much greater portion of drug costs. The point at which a person enters the donut hole currently is after spending $4,430 in a given year.

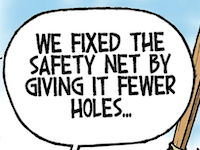

In other words, instead of saving the system money, managed care companies might in some ways be raising the cost of care.

“Rebates create distorted incentives for plans and PBMs,” Ciaccia said. “They often have to chase them even if it affects patient affordability downstream.”

• • •• • •

This story is provided by Ohio Capital Journal, a part of States Newsroom, a national 501 (c)(3) nonprofit. See the original story here.