Key Capitol Hill committees question reasons, effects

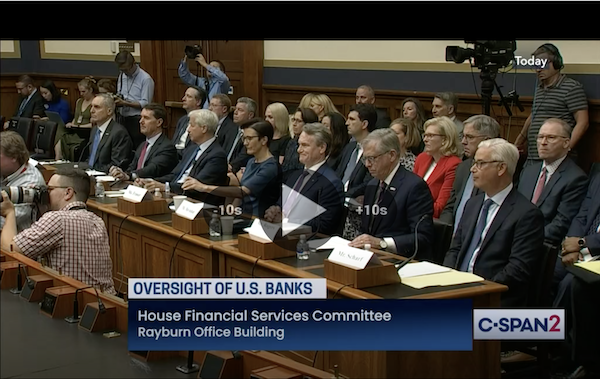

In recent weeks, key Capitol Hill committees held hearings with CEOs of some of the nation’s largest commercial banks. At issue for both California Congresswoman Maxine Waters, Chair of the House Financial Services Committee, and Ohio’s Senator Sherrod Brown, Chair of Senate Banking, are disturbing industry trends like growing mergers, closing bank branches, and a push towards online services that together create ‘banking deserts’ in already underserved communities.

Although bank mergers create institutions with larger assets, for consumers and small businesses alike, these industry moves change where and how communities can access full-service banking.

In opening remarks at a September 16 House Financial Services Committee hearing, Chairwoman Maxine Waters made clear what she hoped the bank CEOs would address.

“Over the past several years, we’ve seen the system of banking in this country take a dramatic shift,” stated Waters. “Our nation’s biggest banks have gotten even bigger during the pandemic, in part, through mergers. Regulators have rubber stamped these merger applications for far too long, and it’s past time we get to the bottom of who these mergers are actually benefiting.”

“I remain concerned,” continued Waters, “that branch closures across the country, which are often a consequence of mergers, are expanding banking deserts and harming communities that rely on branches for basic banking services.”

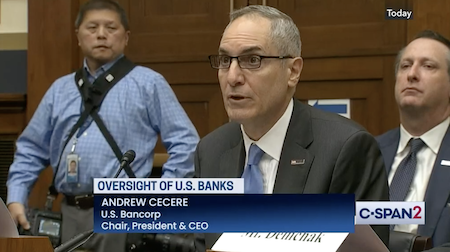

In response to Chairwoman Waters, Andy Cecere, Chairman, President and Chief Executive Officer of U.S. Bancorp, offered a different perspective on industry trends, one that embraces innovation as time-saving, competitive, and convenient tools.

“By using our branch network in combination with digital tools, we enable our customers to be more connected to their financial future,” testified Cecere. “Last quarter, 82 percent of our consumer transactions were enabled by our digital capabilities, with 64 percent of loan sales executed digitally. Digital advancements that differentiate us from the market add to the customer experience.”

Jane Fraser, Chief Executive Officer, Citi shared testimony that seemed to confirm many of the issues raised by Chairwoman Waters.

“Our retail bank serves roughly 70 million customers in the U.S., where we operate 651 retail branches concentrated in the six metropolitan areas of New York, Washington, D.C., Miami, Chicago, San Francisco and Los Angeles,” noted Fraser. “We have fewer than the approximately 1,000 branches we had 10 years ago, but more than the 450 branches we operated at the turn of the millennium. Roughly 29 percent of our branches are in low- and moderate-income census tracts.”

Days later on September 22, the Senate Banking Committee held its own hearing with bank CEOs. And like Waters, Brown’s opening remarks echoed many of the same concerns.

“Together, you have over $13 trillion in assets – that’s half the nation’s GDP,” said Brown. “You have hundreds of millions of customers. You also have the benefit of a federal backstop – a safety net – something that your customers don’t have.”

“And you profit from all those transactions – to the tune of hundreds of billions of dollars. With those profits – and with the taxpayer support you get – come a responsibility to actually serve your customers and the larger economy,” Brown added.

William H. Rogers, Jr., CEO of a recent bank merger that created Truist, was one of the Senate hearing’s witnesses.

“Over the past ten years, Truist closed an average of 193 branches annually,” said Rogers. “Many of these closures occurred following the merger of BB&T and SunTrust, because the two heritage banks, in many instances, maintained separate branches in the same neighborhoods and even on the same street corners. These closure plans were reviewed as part of the merger approval process and had virtually no long-term impact on branch availability or convenience for clients.”

Research by the National Community Reinvestment Coalition (NCRC) documents how still shrinking numbers of bank branches in black and other communities of color diminish the economic futures of communities already reeling from a lack of sustained investment and redevelopment in its reported titled, The Great Consolidation of Banks and Acceleration of Bank Closures Across America.

From 1984 to 2021, the nation’s number of banks shrank from nearly 18,000 to fewer than 5,000, according to NCRC. More than 4,000 of these closures occurred since March 2020, coinciding with the onset of the pandemic. Further, one-third of bank branch closures occurred in majority-minority neighborhoods and/or low-to-moderate income areas, where convenient bank access is often viewed as central to ending inequities in financial services.

“The presence of local branch offices provides an opportunity for face-to-face interactions that build both trust and financial literacy for individual borrowers and small businesses…Today’s larger, less-local banks are still charged with serving the credit needs of the entire community they serve,” the report continues. “Changes in how the public interacts with their bank do not create an exemption to the law.”

Summarizing his committee’s concerns, Chairman Brown underscored to the CEOs what might have been overlooked.

“It’s past time for the financial industry to be as good to the American people as the country has been to you,” concluded Brown. “We will continue to hold you to the highest standards, so that Americans can keep more of their hard-earned money.”

• • •• • •

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.